individual income tax malaysia

Malaysia adopts a territorial approach to income tax. This translates to roughly RM2833 per month after EPF.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

However if you claimed RM13500 in tax deductions.

. Malaysias government has introduced several income tax amendments that will impact individual taxpayers for 2021. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Income Tax Rebates for Resident Individual with Chargeable Income Less Than RM35000. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Income tax exemption is given on 65 of the statutory income of any person from providing qualifying professional services in Labuan to a Labuan entity. Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15.

What is the income tax rate in Malaysia. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. Individuals may carry forward business losses indefinitely. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the.

Headquarters of Inland Revenue Board Of Malaysia. Tax rates in Malaysia The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million. Introduction Individual Income Tax.

Individual income tax return. The individual income tax has been reduced from 14 to 13. The Tax tables below include the tax.

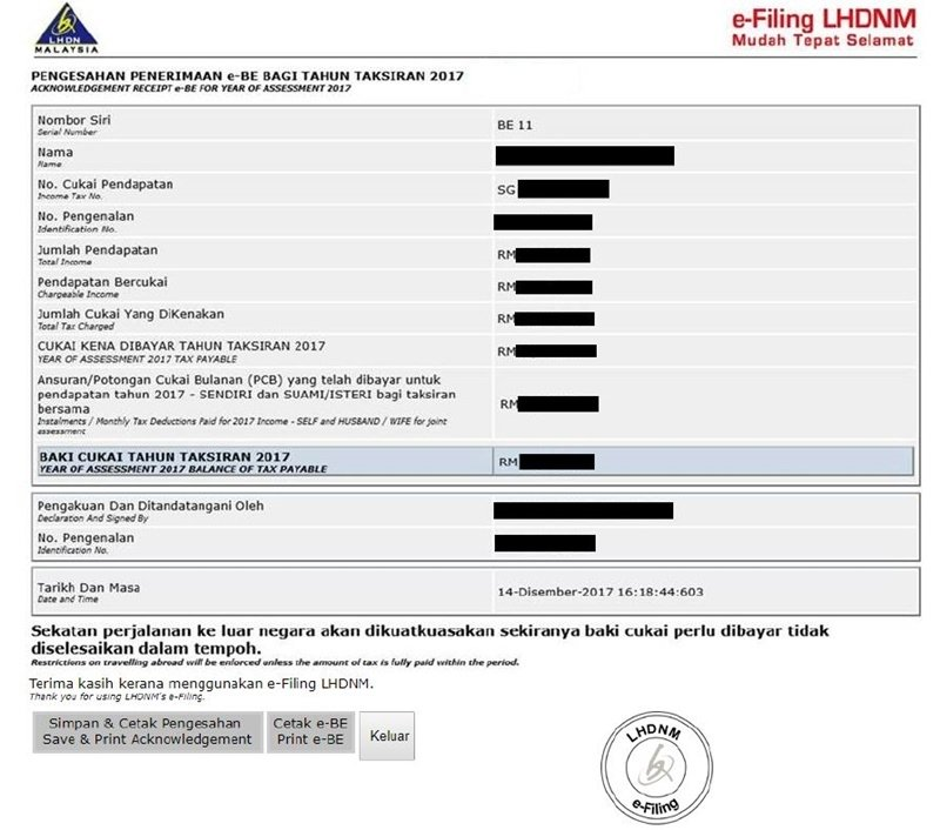

Who needs to file income tax. Under Part II Section 7 of the Income Tax Act 1967 the Malaysian government considers any individual regardless of their nationality a tax resident if the individual fulfils. An individual who earn income in Malaysia is required to declare his income to Malaysian tax authority Inland Revenue Board of Malaysia IRBM also known as Lembaga Hasil Dalam.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Year of Assessment 2001 - 2008 RM Year of Assessment 2009 Onwards RM a. The Malaysian 2016 budget increased tax rates between 2015 and 2016 raising the maximum an individual could pay to 28 percent from its earlier 25 percent.

Individual - Income determination Last reviewed - 13 June 2022 Employment income An employee is taxed on employment income earned for work performed in Malaysia. The Tax tables below include the tax. Malaysia adopts a self-assessment system in which the taxpayer has to compute their own chargeable income and tax and make tax payments.

According to Lembaga Hasil Dalam Negeri LHDN also known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Prs Tax Relief Private Pension Administrator Malaysia Ppa

Malaysia Personal Income Tax Rate 2022 Take Profit Org

150 Individual Income Tax Rates Ya2020 Rate Tax Chegg Com

Big Changes To Foreigner S Income Tax In China Now Delayed Thatsmags Com

Business Income Tax Malaysia Deadlines For 2021

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

The Complete Income Tax Guide 2022

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Personal Tax Relief 2021 L Co Accountants

Malaysia Personal Income Tax 2021 Major Changes Youtube

Updated Guide On Donations And Gifts Tax Deductions

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

0 Response to "individual income tax malaysia"

Post a Comment